NEBULUM.ONE

Complete Beginners Guide to DEX Screener

![]() We build with heart

We build with heart

Learn How to Use DEX Screener Like a Pro in 2025

In this tutorial I’m going to give you a quick introduction to using dexscreener and near the end of this tutorial I’m going to introduce you to some pretty clever methods that we, and students in our no-code Web3 development course use to access important trading data on new trading memecoin pairs before 99% of others have access to this data.

It’s about learning how to read smart contracts so that the data that dexscreener doesnt show you on new trading pairs, becomes visible to you.

So be sure to stick around until the end to see some of this tech wizardry.

What is DEX Screener?

In a nutshell dexscreener allows you to monitor the performance & important trading metrics for new tokens and memecoins on a wide range of blockchains.

In the sidebar of dexscreener here you’ll notice that you can track trending or newly launched coins on a wide assortment of blockchains from Solana and Base to Ethereum, Arbitrum & Hyperliquid.

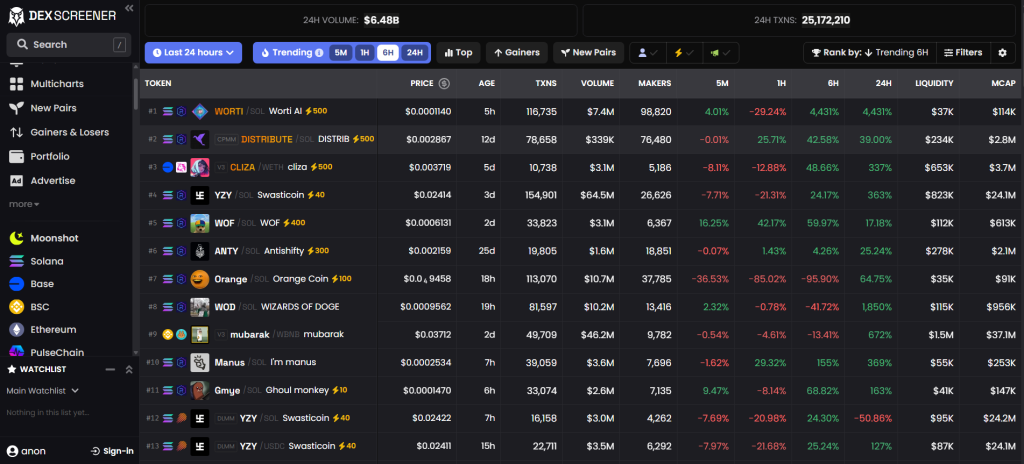

Over the right you’ll see a list of top and trending tokens. The first icon shows which blockchain the token was launched on. You can roll over any of these icons to see name of the blockchain.

The next icon over shows the decentralized exchange the token is being traded on and where it has liquidity. For Solana tokens this will mostly be on Raydium and for any Ethereum tokens or ethereum layer 2 tokens the dex will primarily be Uniswap or PancakeSwap.

How Are Tokens Listed on DEX Screener?

It’s wroth mentioning that any newly added token with any amount of liquidity at all, even just one cent of liquidity and one single trade. will show up within dexscreener. Those are the requirements to get listed. Tokens do not need to ask permission to be listed on dexscreener.

This means that anyone can launch a token and have it show up on dexscreener. It’s entirely permissionless. Which means, of course, buyer beware. In the world of memecoins most coins are scams, rugg pulls or pump & dumps. It’s also very volatile and fast moving.

It’s possible to double your money in a day leaving you feeling like a memecoin tycoon, only to have it all wiped out by a clever rug the day after leaving the tycoon of yesterday feeling like the memecoin degenerate of today. So be careful and never put in more crypto than you can afford to lose. If your just starting out, I suggest setting yourself a small learning budget. This will enable you to put skin in the game and learn the platform.

Over to the right, you’ll see the image and name of the project. It’s important to note that if you see an image associated with the token, this means that in most cases for newly traded memecoins that the project has purchased a premium listing on dexscreener. This costs them a few hundred dollars and is often seen as a sign of project seriousness.

If, for instance, we click on this project, you’ll notice that this project has a banner image and its meta data including website and social details show up in the upper right corner.

You’ll notice that project’s without an image don’t have any of this information on their main listing page. For larger, more established tokens, this metadata is pulled in from 3rd party data aggregators like CoinGecko.

However, for small, newly launched memecoins, things work a bit different. If we were to go back to the homepage and then search for newly listed tokens, you’ll notice that most of these tokens don’t have token images and their listing pages don’t show image banners or the project’s socials. This is simply because the project hasn’t paid dexscreener for a premium listing. However, this doesn’t mean that the memecoin doesn’t have an associated image or socials, it just means it’s hidden. More on this in a minute, because this is where opportunities become abundant for those willing to do a bit of technical upskilling.

Searching Tokens by Chain

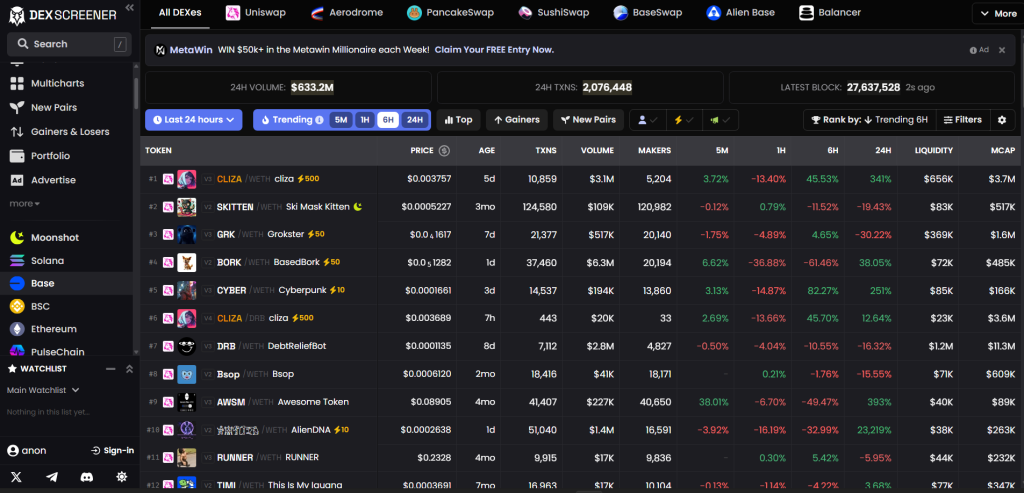

But before we explore that topic, let’s keep moving forward with a general overview of the platform. So Back over on the homepage, we can filter token listings by looking at listings on a particular blockchain. For instance, we can search only on Solana or only on Base. For this tutorial, let’s click on Base. Base is a layer 2 Ethereum chain which is blazing fast and super cheap.

On this page we will only see tokens created on the base blockchain. We can search trending tokens by time in the top navigation bar, or we can scour through the freshly created tokens by clicking on the “new pairs” button. From here, we can filter our search for new pairs created in the last 6 hours, last day and so on.

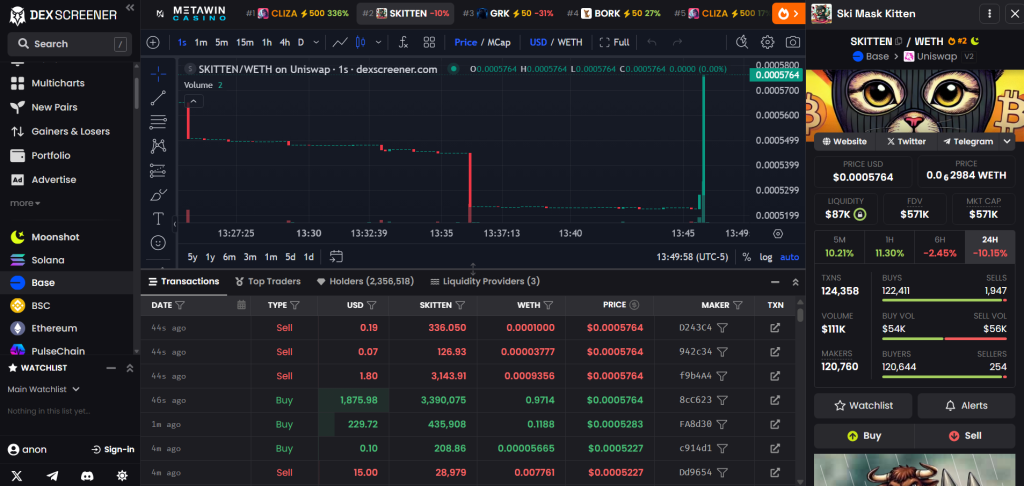

Within the main table (see image above) we can see important trading metrics like the token price, the token’s age, the number of trading transactions, total volume and the number of makers. Makers are simply the number of wallet addresses involved in trading the listed token.

Next, we have the tokens gain or loss over the last 5 minutes, 1 hour, 6 hours and 24 hours. Then over to the far right we see the tokens liquidy pool balance as well as the market cap.

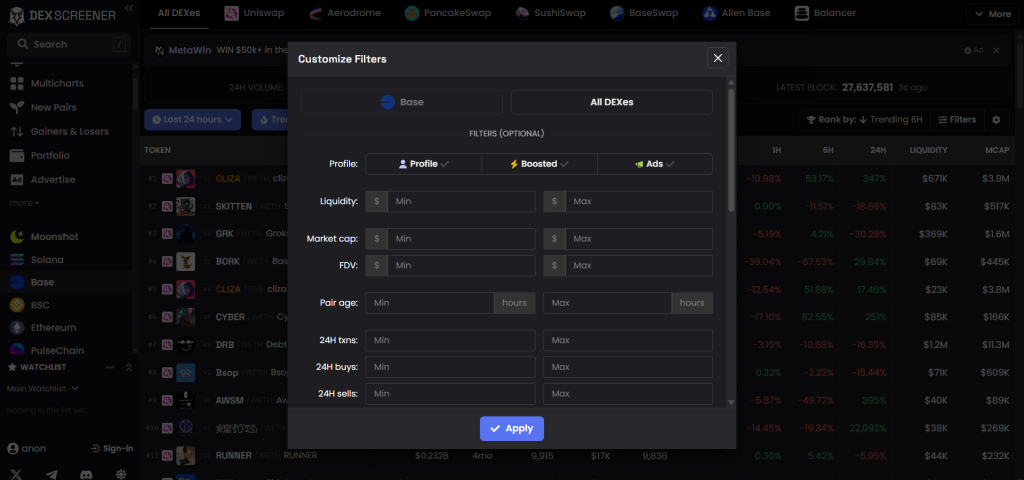

Probably one of the most used features on this page is the filters option.

Using filters we can zero in on projects that meet our memecoin trading specifications. For example, perhaps you only want to show projects with market caps between $10,000 – $100,0000. You can apply those filters here.

So now let’s drill into a new token in more detail by clicking on it.

Token Page

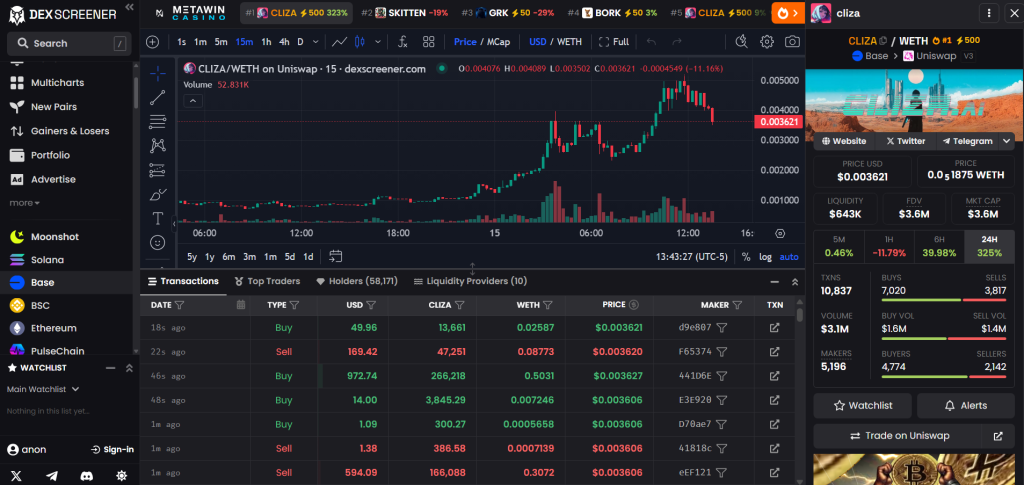

From here, you’ll see the blockchain this token was launched on, as well as its trading pair. For this token, its trading pair is Wrapped Eth. Scrolling down, we’ll see the banner image, as well as the project’s social details.

Below this section we’ll see important trading details. This section expands on what we could see over on the previous page wer were on. For example, here, not only can we see the liquidity of a project, but we can also see if the liquidity is locked. Locked liquidity is important because it means that although the price can fluctuate and you can still lose your money, it does help provide security against rug pulls. Below that we can see buying and selling pressure metrics.

And if we scroll down a bit further, we’ll see details relating to this pair such as the token and token pairs contract address. You can click on these links here to be brought to the blockchain explorer tab for these addresses.

Below this section we’ll see a section for contract health. Here, you’ll see any warnings if there are any for a particular contract. For example, if the contract owner hasn’t revoked their rights to mint more tokens, those warnings will show up here. We have a tutorial on commom memecoin scams you might want to view here.

Lastly, below that we have a boost section which allows anyone in the community to drive more awareness to a project by boosting it.

So that’s a very quick, very top level overview of the platform. So now that you know how the platform works, how should you begin using it to gain an edge?

How to Get an Edge?

Now here there are so many possibilities. This is really one of the most exciting trading spaces right now. Some people design bots to drain liquidity pools, others pump prices in alpha groups or on social channels, some meme coin buyers trade on news or tiktok trends, we’ve created a plugin to track when tokens buy a premium listing (which can result in price increases due to increased awareness) and the list goes on.

So I’m just going to focus on what works for us at Nebulum because it’s something that virtually nobody talks about and to me, it’s much more interesting.

Learn to Exploit Data Lags

So the most successful plays we’ve made at Nebulum have been due to the fact that we’re a technical group and we can use that as a bit of a superpower.

To me, what’s fascinating about these new meme coin markets is that it’s so visible that the markets are not efficient yet. And because of this, there is so much opportunity here for people with even just a bit of technical know-how.

Essentially, you have to be able to spot an inefficiency and then exploit it. In traditional financial markets this has become very difficult as the markets are hyper efficient. Not without anomalies, but almost.

There have been cases, where very smart people, like MIT graduate, mathematician and founder of Medallion fund Jim Simons, have found ways to identify and exploit these inefficiencies, but in Jim’s case, it took him two years and cost him millions before he cracked the code.

But what’s been life changing for many in the meme coin space right now, is that these markets are not overly flooded (yet anyways) with the Jim’s of traditional financial markets, institutional money or quants and therefore exploitable patterns are quite easy to come by.

Also, most of these markets are so small that they are not worth most people’s time. But for an individual meme coin trader, these can be life changing opportunities.

Spotting Innefeciencies

For us, because we’re technical we have a slight advantage. For example, on dexscreener here, you’ll see we can follow this early stage coin. What we’re looking for here is early stage interest in this token. One important metric here is the number of makers. So here we can see the number wallet addresses actively trading this token.

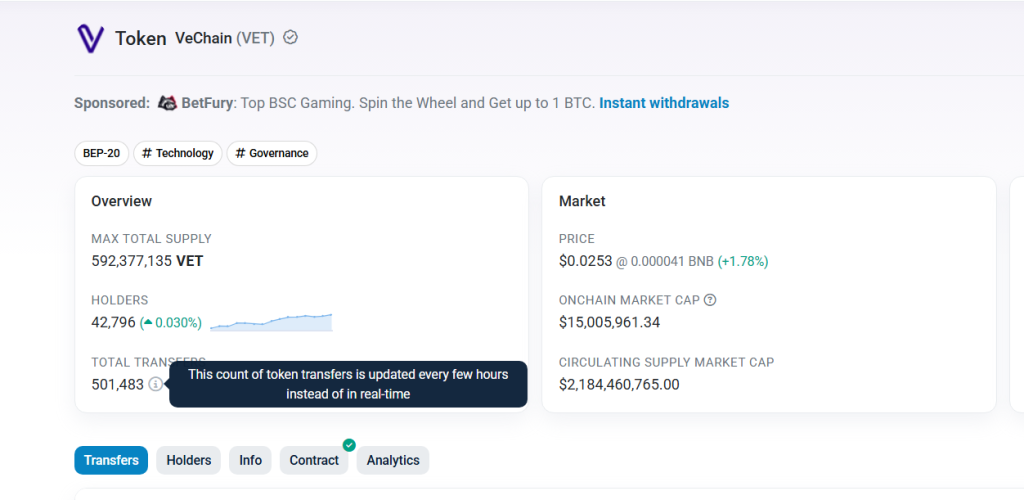

However, we’ve uncovered that on some blockchains there is a slight delay in this value and the actual value within a blockchain node. So we can send a get request to the blockchain to fetch the real time value and this gives us an informational advantage over pretty much everyone else who is using this delayed value. Even those using blockchain explorers are using delayed data. Here I’m on an explorer and the explorer explicitly states that its data is delayed.

While 99.9% of other traders are monitoring this by staring at the exact same screen and seeing the exact same data, all waiting to pounce on a change, we’re creating bots to look for these data lags and therefore we’re able to pounce first on the freshest data. This lag is sometimes seconds, sometimes a minute or two, but this token’s life span might only be 20 minutes to 6 hours. So if we can spot growth before others can, this gives us a huge trading advantage.

This is a topic that we cover in our no-code Web3 development course. In this course we teach our students how to connect to blockchain nodes directly so they can get their data from the source rather than relying on delayed third party sources.

Metadata

Another strategy that we use to gain an informational advantage is to source a project’s metadata before they’ve paid for it to be displayed. Remember, previously I told you that new tokens don’t show up with an icon or any metadata, because they need to pay for it to show up on dexscceener.

However, that doesn’t mean that the data doesn’t exist. Let’s take a look at any non-premium listing on dexscreener. When these memecoins are first launched on dexscreener they shows up without any image or social information. So anyone who is going in early here, is going in blind.

However, just because the project data is not showing up, that doesn’t’ mean it doesn’t exist. Although, we can’t see it on the screen right now, this token address could have an associated image, a website, social channels and a description where we can learn more about it.

Dexscreener wants to incentive projects to buy their premium listing, so they won’t go out of their way to show additional project data for free. And honestly the data is a bit hard to parse due to inconsistencies in contract code, so it’s not surprising that dexscreener takes this approach.

However, as meme coin traders looking for an edge, there is a workaround.

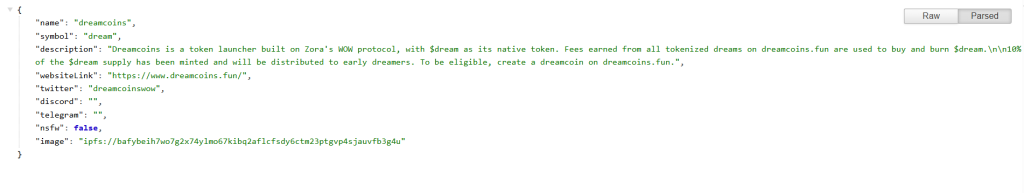

When any of these little tokens are launching on dexscreener, there is a section in their smart contract often called something like “contract URI” or “token URI”. A contract or token URI is a method that returns a URL for the metadata of a contract. This metadata can include information about the contract, such as its name, description, socials, website & image.

So let’s take the same token address we were looking at before. Right now, every trader on dexscreener seeing this contract address is seeing the same thing. None of us know anything about this project other than this long string of text and its token symbol. Without a website, image or socials, we’re trading blind. Any trading taking place with this limited information is purely speculative and technical.

However, because I know how to use IPFS, I can browse this contract’s Contract URI info, and then fetch the metadata… and then look at what happens.

Here, I get access to the name & symbol which everyone gets access to on dexscreener. But look here… I also get access to the description, website, Twitter and image.

So now we can see, before 99% of other people trading memecoins on dexscreener, this newly launched project’s art, social channels, posting frequency, age, and website.

Conclusion

Now obviously, I’m just skimming the surface here and there is much more involved and much more that needs to be considered. My goal today was to simply show you what’s possible.

But as you can see, you can exploit informational asymmetries between groups of people. Even though this knowledge is publicly available. It’s difficult for non-technical people to understand creating an imbalance in knowledge between different parties.

This is a big part of what we do for our clients at our blockchain development agency.

Want to Learn how to Do This Yourself?

If you’re interested in learning how to take advantage of informational asymmetries like this, then consider enrolling in our Web3 development course. Enrolling our course will give you a HUGE advantage over other traders who are just speculating or relying on gut instinct.

In the future, I expect these inefficiencies and data lags to close as the market becomes more efficient, but for now, and probably for the next year or so, these inefficiencies will remain pretty visible to those who know how to look for them.

So, that’s all I have for you today.

Thanks for stopping by.

Build a Frontier Tech Company Without Code

Build breakthrough AI, ML, data, robotics, biotech, aerospace and web3 applications without code. From prototype to production-ready systems in weeks, not years.

![]() We build with heart

We build with heart

A no-code innovation platform that helps non-technical people build technical software applications, bots and automations.

![]() Version 1.1.1

Version 1.1.1

COMPONENTS

Bubble Components

Landing Pages

SaaS Dashboards

Bubble Templates

Bubble Plugins

Bubble Designs

TEMPLATES

Landing Page Theme

Automation Theme

SaaS Dashboard Theme

AI Model Theme

ML Theme

Data Analytics Theme